UAE Gambling: 2024 Recap and 2025 Projections

Dramatic spikes in regulated sectors like the UAE Lottery, modest trends in physical casino searches, and growth in online gambling.

We analyzed last year’s data, key events and connected the dots to what’s next – get to know the major events of 2024, the trends for 2025, and the big picture of what’s ahead for the UAE gaming scenario.

Last Update February 19, 2025

How We Did It

Ahrefs

Using Ahrefs, we conducted keyword research and analyzed search volumes and other metrics, gaining valuable insights into popular search queries.

Google Trends

Using Google News, we analyzed key events related to gambling in the UAE over time and compared them with variations in gaming-related search terms.

In-Depth Analysis

We combined data from Ahrefs with a timeline of gambling-related events to provide actionable insights into casino searches in the UAE.

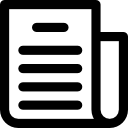

2024 in a Big Picture

GCGRA Loses Momentum as UAE Lottery Takes the Spotlight

Search interest in GCGRA dropped by approximately 58.5% over the year, but there’s a clear correlation—the focus shifted to the UAE Lottery when The Game LLC secured the first gaming license in the UAE.

With an astounding increase of roughly 3,100%, the UAE Lottery saw an explosive surge in searches, making it the biggest winner of 2024.

Wynn Gains Momentum, Casino Interest Remains Steady

With ongoing licensing processes and construction projects, interest in the topic remained moderate. At the beginning of January, people were more curious about physical casinos, such as Wynn Ras Al Khaimah and the establishment of MGM in Dubai.

Overall, public interest in these projects was sustained, but in October, searches spiked by 17% compared to September when Wynn Resorts received its first commercial gaming operator’s license.

Online Gambling Growth Continues

Online gambling saw a growth of approximately 61%, indicating a significant shift toward digital gaming platforms. Even though it’s not yet regulated, interest in the topic continues to rise.

Additionally, searches for online casino platforms increased steadily by around 28%, suggesting consistent and growing interest in digital casino experiences. With GCGRA licensing online providers, new developments in this space are expected in 2025.

Did You Know?

-

6 Licenses Were Granted

The GCGRA has granted licenses to six entities so far—including a lottery license for The Game LLC, a land-based license for Wynn Al Marjan, and four vendor licenses to companies such as Aristocrat and Smartplay.

-

No License Online Gambling

The UAE’s booming gambling market has already seen over six licenses granted, yet the GCGRA has not approved licenses for Internet and Sports Wagering. This could indicate an future evolution in digital regulation.

-

Pending Approval for a Major Player

Despite its strong brand presence, MGM Dubai has yet to receive its GCGRA license. Fans and industry watchers are eagerly awaiting the day when regulatory approval unlocks new opportunities for this iconic venue.

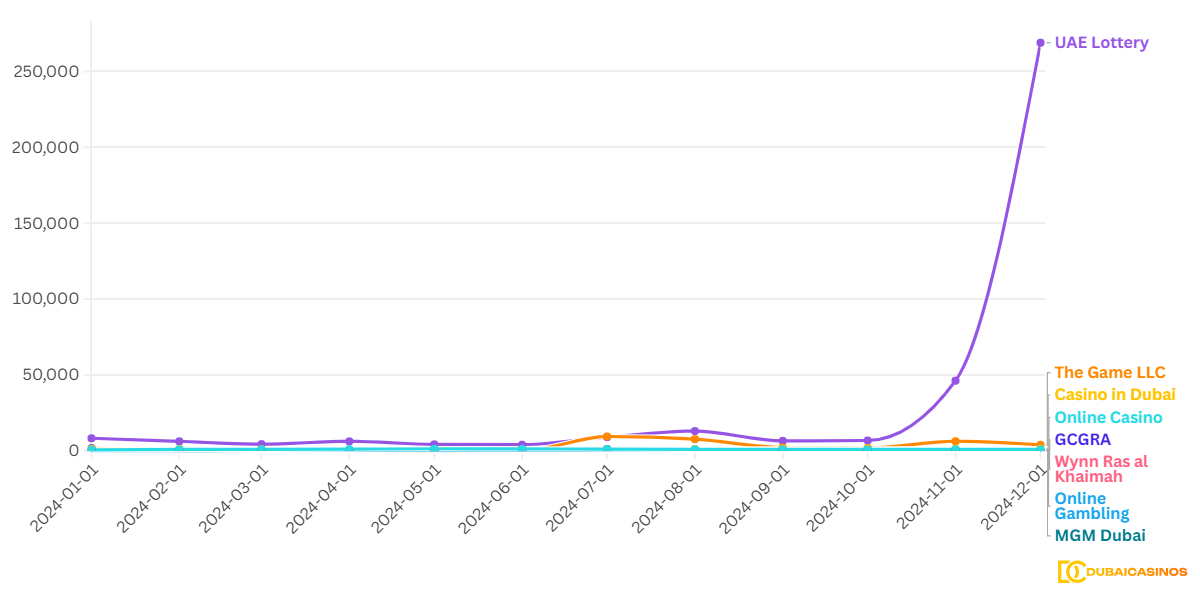

2025 So Far: Lottery Drop

Licenses, UAE Lottery, and GCGRA

The dramatic surges from late 2024 have mostly faded. For example, the UAE Lottery saw over a 50% drop from December to January, and The Game LLC fell by nearly 87% after its previous spike.

Meanwhile, GCGRA experienced a moderate dip followed by recovery. This suggests that while event-driven news can create huge short-term buzz, their impact tends to normalize quickly.

Normalization of Market Interest

As the market matures, we can expect fewer dramatic spikes and a steadier level of engagement—providing a more predictable environment for both operators and regulators.

The 2024 and 2024 suggest that while headline-making licensing events can trigger short-term buzz, the underlying interest tends to settle into a more stable, sustainable pattern over time.

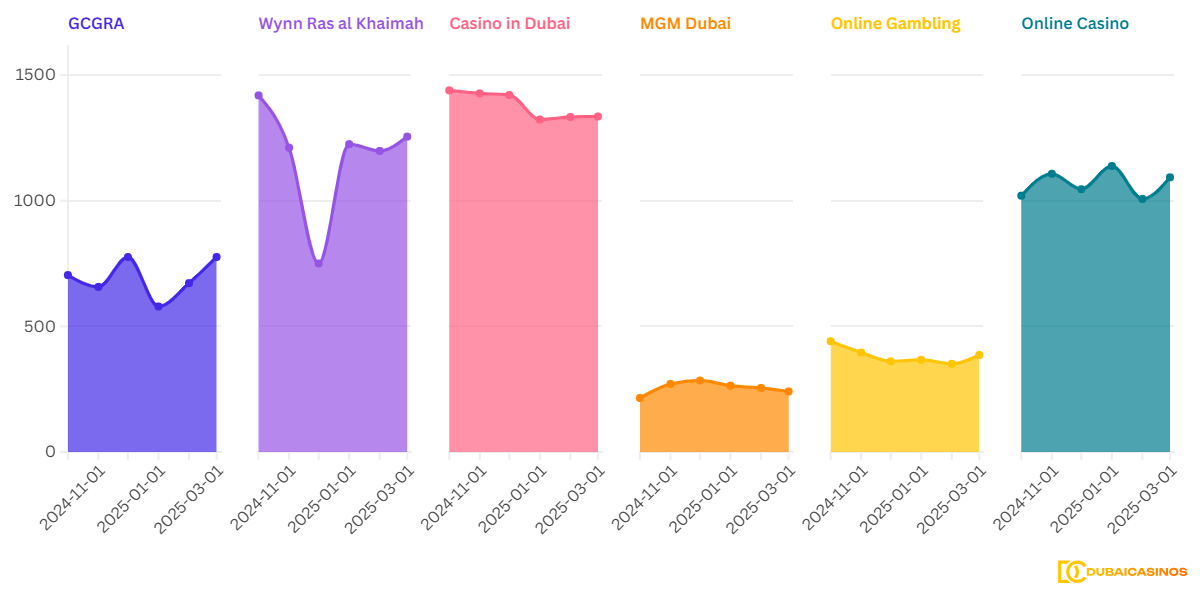

2025 So Far: Shifts in Physical and Online Casinos

Localization, Physical Casinos, and Wynn

Wynn Ras al Khaimah stands out with a strong rebound—up about 63% from December to January—indicating that licensing updates continue to capture public interest.

In contrast, terms like Casino in Dubai and MGM Dubai remain steady with only small percentage changes, reflecting consistent local engagement regardless of headline events.

Online Gambling

Both Online Gambling and Online Casino searches show modest fluctuations (around ±10%).

This steady performance suggests that digital gambling continues to attract a reliable, stable audience, unaffected by the episodic events that impact the licensed and localized sectors.

What’s Next for UAE Gambling in 2025?

1. Imminent Regulation of Online Gaming and Sports Betting

The online gambling sector is already well-established and stable, showing only minor fluctuations of around ±10% month-to-month, even without official licensing.

The introduction of Internet Gaming and Sports Betting licenses—currently the only major segments without regulation in the UAE—will likely spark significant surges in public interest, similar to past market shifts.

It is expected that the GCGRA will expand its regulatory framework in 2025, bringing these segments under legal oversight to offer users secure and regulated gaming options.

2. Growth of Physical and Hybrid Gaming Venues

Interest in Wynn Ras Al Khaimah surged by 63.3%, largely driven by recent licensing announcements, highlighting strong public engagement with land-based gaming projects.

This trend suggests that as more land-based and hybrid venues (combining gaming, hospitality, and leisure) advance or receive approvals, interest will continue to grow.

2025 is likely to see further expansion in this sector, with hybrid venues playing a key role in diversifying revenue streams and attracting a broader audience.

3. Strengthening of the Gaming Vendor Ecosystem

The GCGRA has recently licensed several gaming-related vendors, including Aristocrat Technologies Europe, Smartplay International, PayBy Technology, and Xpoint Technology.

As these companies introduce new products and innovations, they are set to enhance both digital and physical gaming experiences—whether through lotteries, prize draws, or integrated gaming systems for online and land-based casinos.

With continued investment in gaming vendor licenses, 2025 could mark the beginning of more real gaming opportunities for players, driven by an expanding technological ecosystem.

SiGMA Eurasia 2025: A Key Hub for UAE Gaming’s Future

While gambling is already a hot topic in the UAE, the upcoming AIBC Eurasia Conference in Dubai from February 23–25, 2025, hosted by the SiGMA network (which has a strong presence in the iGaming space), further highlights its growing relevance.

Although AIBC Eurasia is a broader technology conference covering blockchain, AI, fintech, IoT, quantum computing, and big data, its focus on gambling signals that the industry is here to stay in the UAE in 2025.

Our Work

We did it before. If you’re interested, we have some previous reports you can review.

-

How Has Gambling News Impacted UAE?

We analyzed gambling news in the UAE and search trends to understand how these events are driving public interest.

READ REPORT -

What Emiratis Think About Casinos?

We conducted a survey in the UAE, reaching out to over 10,000 individuals and receiving feedback from 3,000 respondents.

READ REPORT -

Is Casino Curiosity Growing in the UAE?

This report provides insights into the online search behavior of UAE residents about casino and gambling topics.

READ REPORT -

Will Wynn Resort Change RAK?

Over the course of six months, we conducted a comprehensive survey across the UAE, gathering feedback from 2,000 residents.

READ REPORT -

Exploring Online Forums

Over 170 opinions and 48,000 readings – what Dubai locals are saying about the future of casinos in the city.

READ REPORT

About Us

We are dedicated to providing you with the most comprehensive and up-to-date information on casinos in Dubai and the broader UAE.

We go into the legal intricacies and cultural considerations surrounding gambling in the region, ensuring that our readers receive the most accurate and insightful coverage.

We strive to simplify complex legal concepts and present them in an accessible manner, making our content engaging and informative for all.